Tod's Delists from Italian Stock Exchange Short-Term Investors Demands

/After 22 years, Tod’s Della Valle family want to delist Tod’s Group from the Italian Stock Exchange, offering stockholders a premium on their shares to essentially take their profits and go home — so that Tod’s can manage its business affairs with a more brand-building, longterm-success strategy.

“Brothers Diego and Andrea Della Valle control 63.64 percent of Tod’s shares. Delphine S.A.S. under the LVMH Moët Hennessy Louis Vuitton Group will remain in the Tod’s capital with its current 10 percent stake,” writes WWD.

Accordingly, the Della Valle family “is determined to promote and sustain this project” in light of the quality of the company’s brands that include Tod’s, Roger Vivier, Hogan and Fay; and the managerial, creative and artisan skills of its humans.

As a public company, it would be more difficult “to reach these goal in the medium and long-term,” given the “limitations derived by the need to report short-term results,” the company’s announcement said.

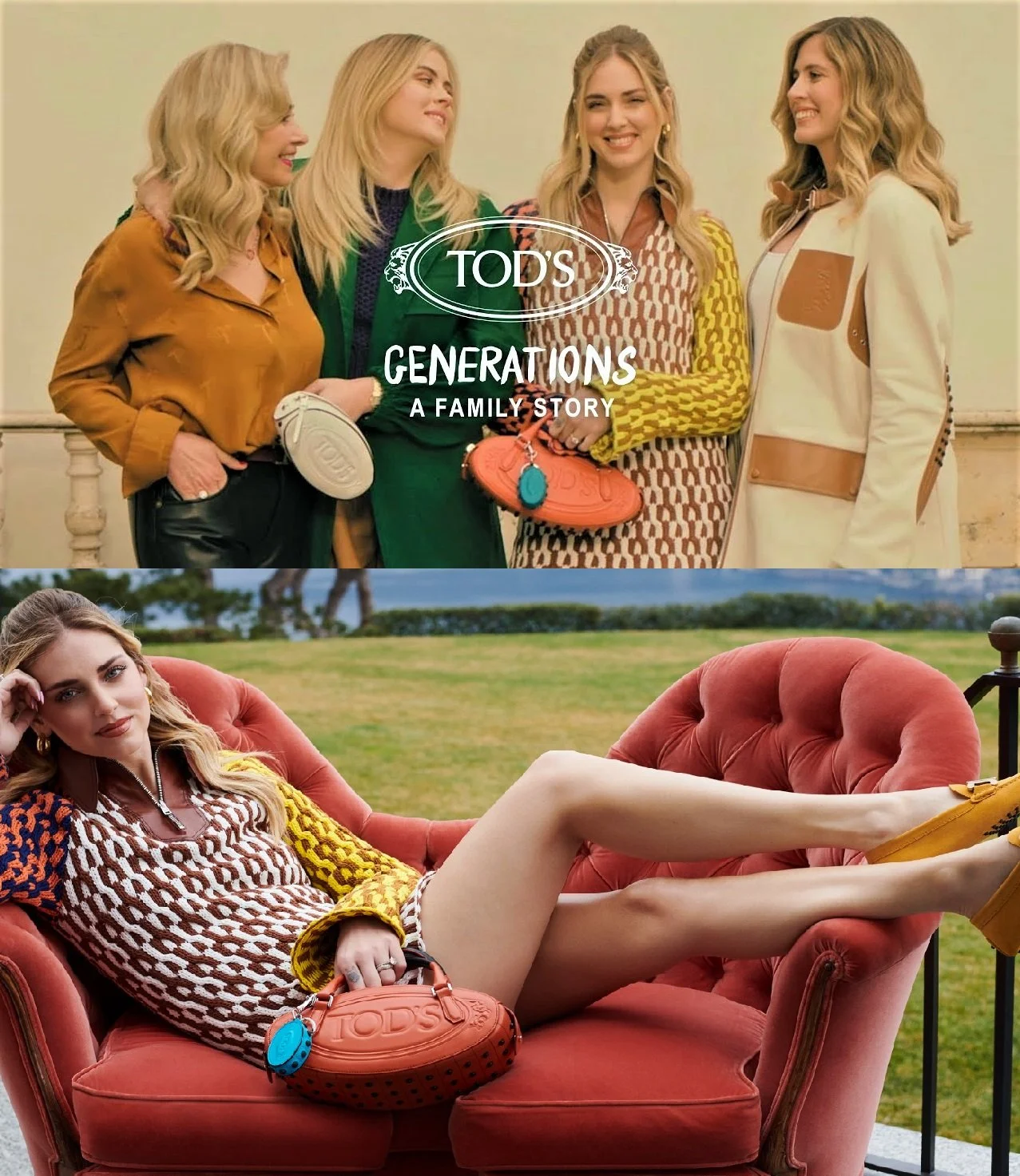

In the first three months of 2022, Tod’s sales rose 23 percent over 2021. Among the rejuvenating strategies employed by the group in its strategy to reach out to Gen Z was the appointment of Chiara Ferragni, founder of ‘The Blonde Salad’ as a board member deeply involved in digitalization.