A 14.5 Billion Dollar Engagement Ring: Why Tiffany Should Say "Yes" to LVMH

/Update Nov. 25, 2019: LVMH Announces Acquisition of Tiffany & Co for $16.2 Billion | Biggest Deal Ever in Luxury

By Isabelle Chaboud, Associate Professor of Financial Analysis, Audit and Risk Management - MSc Program Director in Fashion Design & Luxury Management, Grenoble School of Management (GEM); First published on The Conversation

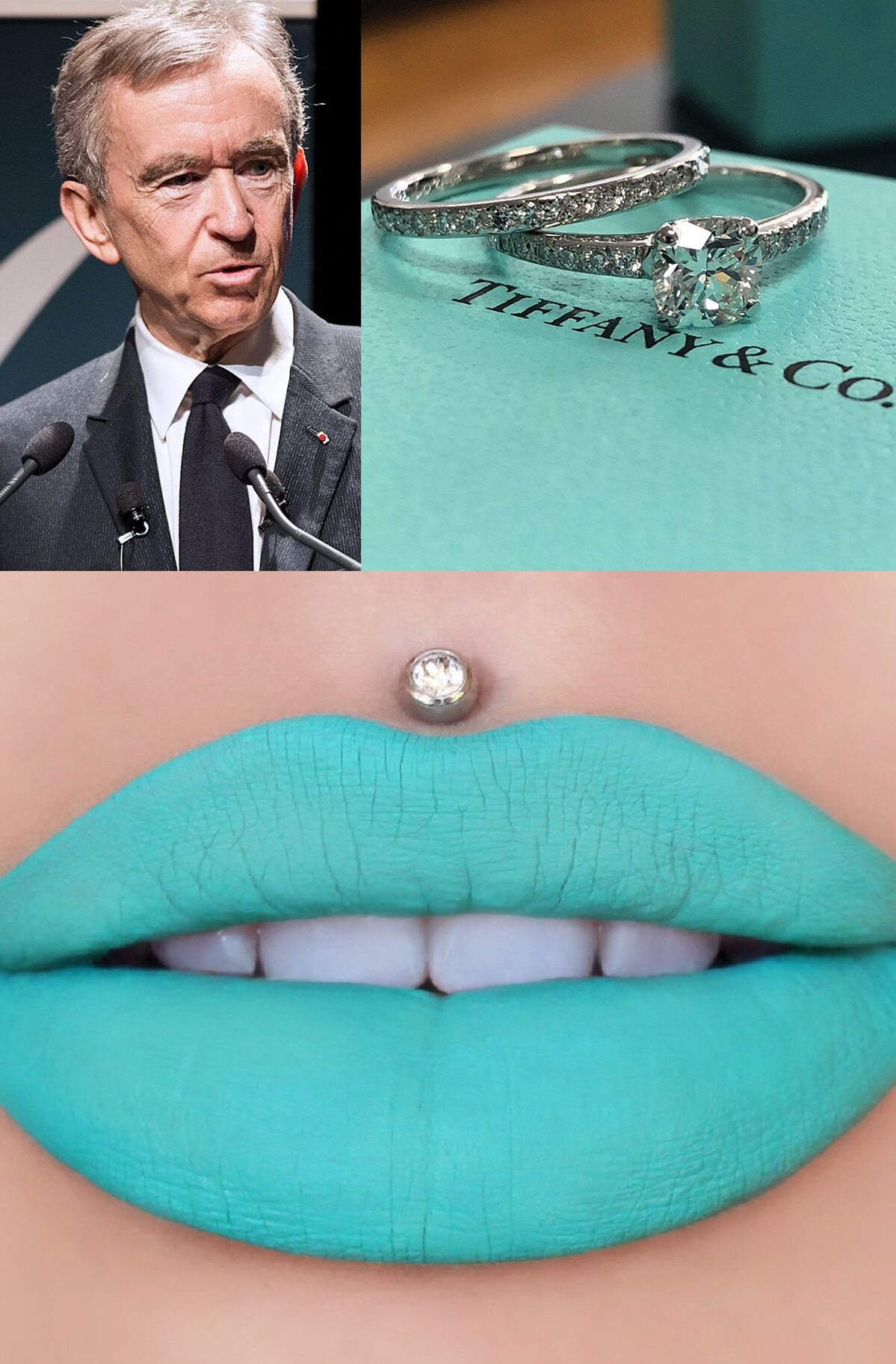

On October 28, 2019, Tiffany & Co confirmed that it had received an unsolicited but non-binding offer from LVMH to purchase its securities at $ 120 per share , an offer of $ 14.5 billion. What are the six main reasons that can push LVMH to a transaction of this magnitude? What impact would this acquisition have on the financial structure of the French group? What about the fact that Tiffany & Co's board is asking for an increase in the offer?

The Tiffany diamond

Created in 1837 by Charles Lewis in New York City where the Fifth Avenue store has quickly become the temple of elegance and sophistication in the field of precious stones, the house, easily identifiable by its small blue box, the famous "blue box", represents an iconic brand for Americans. Originally known for its diamonds and engagement rings, the jeweler enjoyed a growing success until the 1990s. Brought to its peak in the 1960s thanks to the interpretation of Audrey Hepburn magnetized by the windows of Tiffany in "Breakfast at Tiffany's", Tiffany & Co had been looking for a few years to modernize its image.

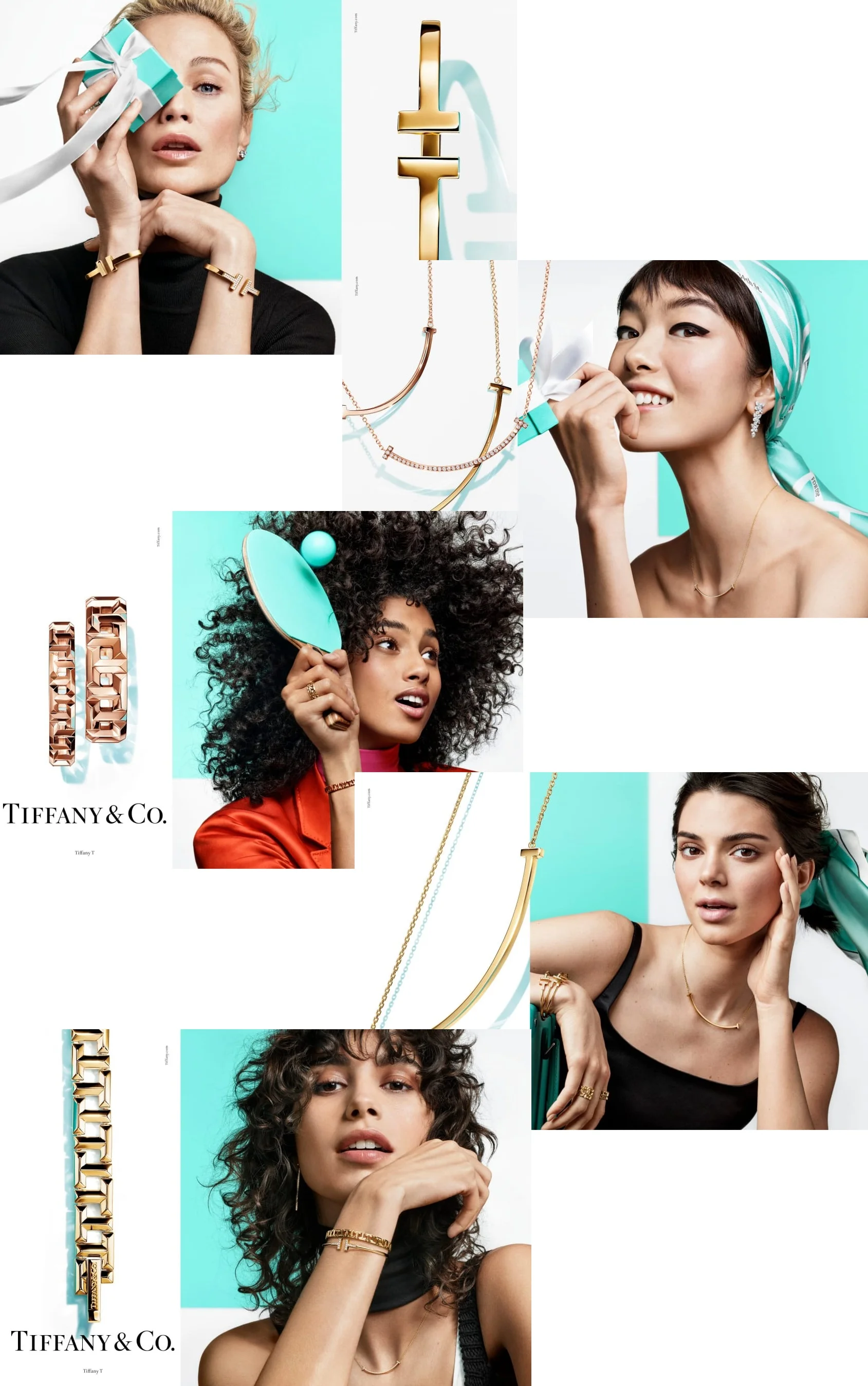

Alessandro Bogliolo (former CEO of Diesel SpA, an Italian-based international apparel and accessories company) took the helm in 2017 with a new artistic director, Reed Krakoff. The company is making significant efforts to personalize the customer experience and products with its "Make it My Tiffany" program. Tiffany is succeeding in attracting a younger clientele. After a few years of sales down from 2015 to 2017, the turnover increases again to $ 4.4 billion over the last financial year ended January 31, 2019 (+ 7% compared to January 31, 2018) and the result net reached $ 586.4 million (13.2% of sales).

Today, Bvlgari (purchased in 2011) and Chaumet are the LVMH Group's two flagship brands in the jewelery sector. A new acquisition in this rapidly growing sector ( + 7% according to Bain & Co ) therefore makes perfect sense. Not only would it allow LVMH to take market share from its main competitor, Richemont (Cartier, Van Cleef & Arpels), whose sales in the jewelery business amounted to 7 billion euros on 31 March 2019 , the acquisition should also allow sharing of expertise. For example, Louis Vuitton, present in jewelry but whose recognition is still lagging, despite the arrival in 2007 of Lorenz Baumer as artistic director of jewelery, could benefit from the know-how of Tiffany's craftsmen, as well as refining its training programs for expert jewelery salespeople.

Geographically, this merger would consolidate LVMH's ties with the United States, already reinforced with the inauguration in October 2019 of a Louis Vuitton leather goods factory in Texas . It would help secure access to the US market (Tiffany & Co's main market) and would no doubt be a major asset if additional duties or taxes were to be implemented on imported luxury goods.

At the same time, LVMH would reach Chinese customers with other Tiffany products (range extension), a market in which Tiffany is very present, just like LVMH and which seems to continue to grow. Bain & Co is still forecasting growth of 18 to 20% in 2019 for mainland China and Frédéric Arnault indicated on November 5 at the Shanghai International Import Fair that LVMH saw no sign of slowing down in Chinese consumption .

Finally, two other points seem important to mention. Firstly, LVMH and Tiffany declare that they share the same priorities in terms of sustainable development. Regarding sustainable development Tiffany & Co has undertaken considerable efforts in terms of traceability of the supply of precious metals (gold, absence of diamonds from areas of armed conflict, etc.). Second, both groups opted for an omni-channel distribution strategy (in physical stores and online). By combining their strengths, the two players would further consolidate their bargaining power.

LVMH has the means

An acquisition of this magnitude would be the biggest acquisition ever made by LVMH, but the French group benefits from a very solid financial structure. At December 31, 2018, its debt ratio (financial debt to equity) was only 32.5% and the group had a cash position of 4.6 billion euros . Its cash is close to 4 billion euros at June 30, 2019 .

Although, at the end of 2019, the restatement of IFRS 16 (recognition as rental debts of all lease commitments) will automatically lead to an increase in the group's financial debt, the LVMH share price has risen 56% since the beginning of the year 2019, closing at 403.4 euros on November 12, 2019.

LVMH remains by far the first market capitalization of the CAC 40 to 203 billion euros on November 12, 2019. An acquisition financed partly by cash exchange, or financed by debt and partly by exchange of shares, is therefore quite conceivable and would not weaken the French group.

Incidentally, the profitability displayed by Tiffany & Co, with 63.3% of gross profit for the last financial year and a net profit ratio on sales of 13.2% (ratios calculated from Tiffany's annual report 31 January 2019 ), is very close to that of the LVMH group. At December 31, 2018, LVMH posted a gross margin rate of 66.6% and a net sales result of 13.3% (ratios calculated from the 2018 Reference Document unfortunately, we do not have the profitability for the jewelery activity only).

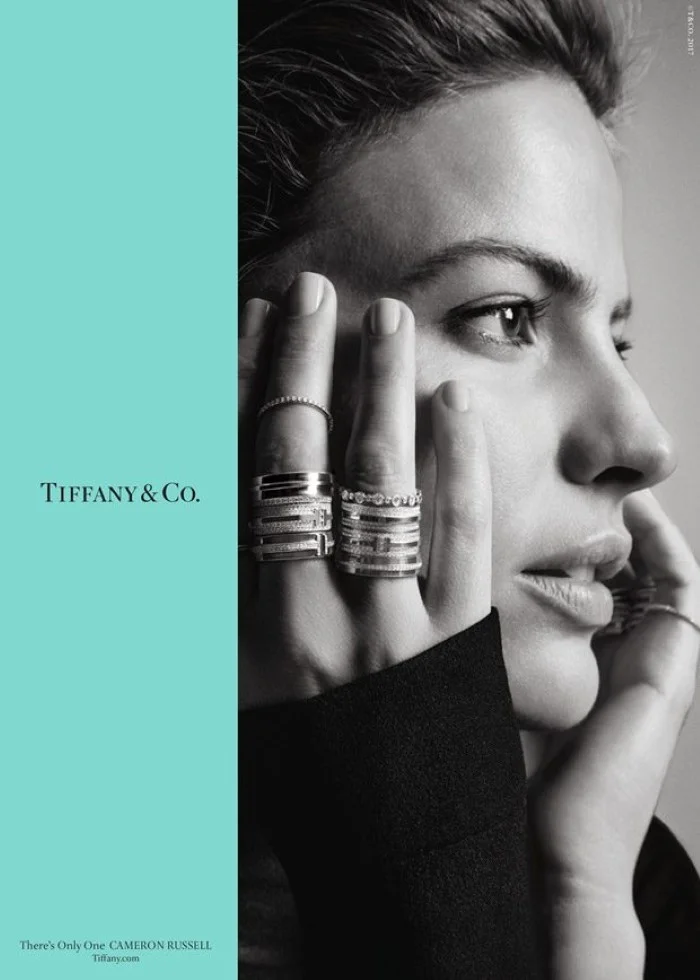

Tiffany & Company 2019 Holiday Campaign

An offer to ponder

Tiffany's board has indicated that it wants to raise the offer but this position seems somewhat presumptuous. As of November 12, 2019, Tiffany's market capitalization is approaching $ 15 billion (a slight decrease compared to the previous week), but the increase in the title is only associated with the LVMH offer. Prior to the bid, the stock closed at $ 98.55 on October 25, 2019 since the stock price soared to $ 129.72. Indeed in the year 2019, the title was between 80.51 and 109.55 dollars maximum in May 2019. If LVMH withdraws its offer, the share price would fall again.

Tiffany is an iconic home, but according to the latest Interbrand 2019 report ranking world brands, Tiffany & Co appears in the 94th place with a valuation of the brand at $ 5.3 billion. Of course, this is only an indicator, but when we look at the accounts of Tiffany & Co at the end of January 2019, the turnover amounts to $ 4.4 billion and the result before depreciation, interest and taxes (EBITDA) at $ 1.4 billion, we see that the current offer made by LVMH represents a high multiple of 10.34 times the EBITDA. It should also be noted that Tiffany's net income / sales of 13.2% as at January 31, 2019 is artificially inflated compared to the 8.9% increase in 2018, given the significant drop in the tax rate on income tax. companies in the United States that has been reduced to 21%.

In our opinion, the jeweler American should still think about this offer because it has issues to resolve, including a very large inventory. With $ 2.8 billion in inventories as at January 31, 2019, the US jeweler has a record inventory turnover ratio (inventory / cost of sales) of 536 days in 2019, which is increasing compared to 2018 (520 days in 2018). A ratio incommensurate with that of LVMH 288 days, which is already high.

LVMH may slightly raise its offer, it has the means nevertheless do not forget that LVMH will also have to finance the acquisition of Belmond Ltd in 2019. Tiffany should not be too greedy and consider it with all the opportunities that she understands. In our opinion, If LVMH made an offer at 125 or even 130 dollars, Tiffany should accept the offer without hesitation. While LVMH will benefit from the jewelery expertise of the US group, it will integrate the world's largest luxury group with a solid financial structure and financial support, marketing and innovation services that should allow it to pursue its strategy and solve its problem. of stocks.

Both groups clearly share the same priorities in terms of sustainable development, product positioning, range extension, customer experience and distribution channels. Tiffany announced the transformation of her New York flagship for 2021 to bring a totally new experience to her customers, and launched a campaign to believe in her dreams. Will the bringing together of the two groups be the occasion to concretize them?

Spring 2018 Paper Flowers Collection by Tiffany & Co.

Director: Francis Lawrence; Featuring: Elle Fanning, A$AP Ferg, Maddie Ziegler; Set Design: Stefan Beckman; Choreographer: Ryan Heffington;

More Tiffany & Company articles on AOC. Industry articles about the LVMH bid for Tiffany’s follow.