Bernie Sanders Launches Wall Street Slugfest With Hillary Clinton While A Reality Check Says Uber Capitalism Is Rampant Beyond Wall Street | Is Sanders Over Simplifying The Problem?

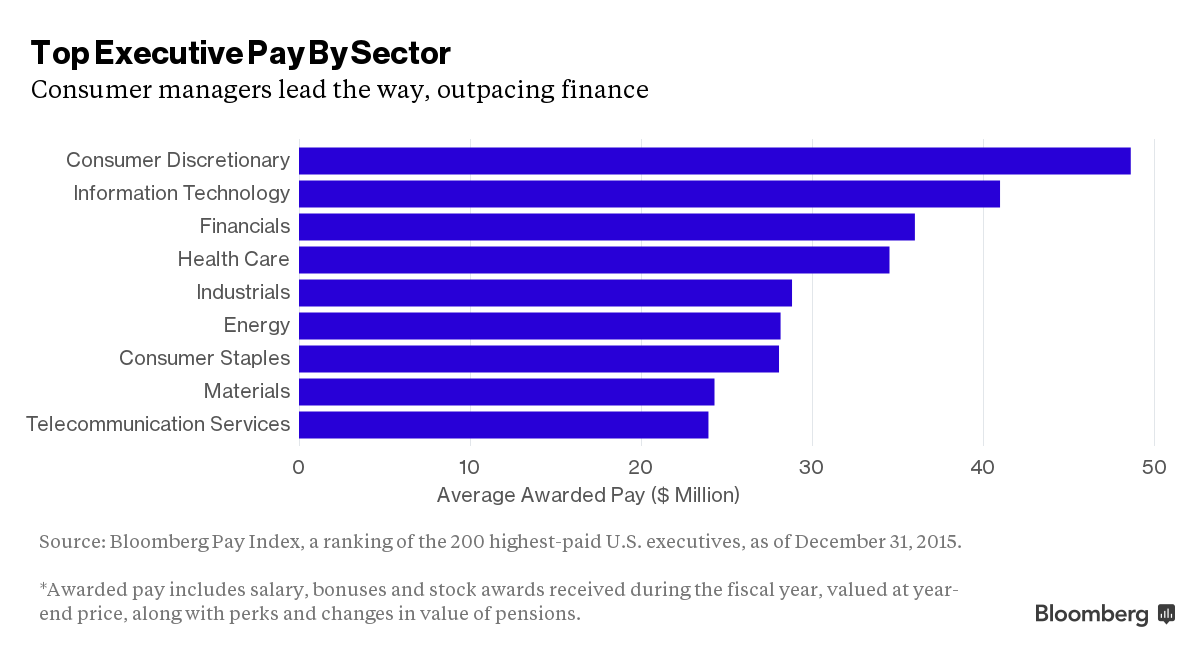

/The Best-Paid US Executives Don't Work on Wall Street Bloomberg News

Democratic presidential candidate Bernie Sanders has made a total demon out of Wall Street. He promised yesterday to break up the big banks at once, even though he has NO power to do that. His appointees who could impact some regulations would have limited powers and would have to be approved by the Senate. Neither Republicans nor key Democrats have shown any desire to break up Wall Street via appointments or -- goddess forbid -- legislation. This is surely a key reason why New York's top progressive mayor announced yesterday his support for candidate Clinton's reform plan.

Bloomberg provides data suggesting that Bernie Sanders may have to break up the Fortune 500 as well. And super successful startups like Go Pro founder Nick Woodman (featured in photograph above) -- off with their heads. Because business is even more egregious than Wall Street in paying its business executives. Think Bill Gates (no longer active in Microsoft management), Warren Buffett, Steve Jobs (dead), Amazon, Bloomberg, and the list of companies goes on. The multiplier between median staff salaries and executive compensation has skyrocketed in recent years.

A reality check voter knows that the problem is far more complex than breaking up the banks and making Wall Street the super villain. Not that we're in love with Wall Street. We are NOT.

The Complexity of Uber Capitalism

We just think Hillary Clinton has a deeper understanding of the complexity of today's uber capitalism and the range of what can be accomplished in reforms. She probably also knows that Bernie's beloved Sweden now scores higher than the US in entrepreneurial startups. And guess what is happening in the country that has turned its economy around, because it was in the ditch with its old-school, socialist model? The problem is nowhere as bad as in America, but the executive vs worker salary gap is increasing substantially.

Hillary Clinton knows we live in a very complex economic world. Bernie Sanders -- perhaps Bernie should dig a bit deeper into the facts. And if he breaks up the banks, and Amazon, and Apple, and the whole damn Fortune 500 . . . Exactly where will our jobs come from? Just asking. ~ Anne

On a related note, Ezra Klein just posted this VOX article, in response to "Silicon Valley's philosopher king Paul Graham's essay on Economic Inequality. In a quick scan of Ezra's article, I will point out this his big data chart stops in 2007. It's almost 10 years later, which may explain some of the differences between Klein and Graham.

Bernie Sanders Attacks Hillary Clinton Over Regulating Wall Street New York Times

Democratic challenger Bernie Sanders had a lot to say at a Town Hall in Manhattan yesterday. He delivered his strongest criticism of Hillary Clinton to date, saying:

“My opponent says that as a senator, she told bankers to ‘cut it out’ and end their destructive behavior,” Mr. Sanders said of Mrs. Clinton. “But, in my view, establishment politicians are the ones who need to cut it out. The reality is that Congress doesn’t regulate Wall Street. Wall Street and their lobbyists regulate Congress. We must change that reality, and as president, I will.”

Mr. Sanders said that Mrs. Clinton was “wrong” to oppose his plan to reinstitute the Glass-Steagall Act, which would legally separate commercial banking, investment banking and insurances services. And the senator implicitly criticized Mrs. Clinton for being a patron of bankers when he pointed to their huge campaign donations and noted that they “provide very generous speaking fees to those who go before them.”

For her part, candidate Clinton pushed back, saying that her proposals actually go far further than Sanders', although Hillary Clinton is not vowing to break up the big banks. What Sanders fails to acknowledge is that all of his Treasury appointments as president require approval by the Senate. Among both Republicans and Democrats -- and surely under Sen. Chuck Schumer (D. NY) as incoming Majority or Minority Leader after Sen. Harry Reid's retirement, the Senate will not approve anyone who wants to shut down the big banks. Candidate Sanders speaks of powers that he actually doesn't have, although his audience doesn't appear to understand that reality.

Clinton stressed her regulation of the 'shadow banking sector', untouched by Sanders. This is the wide range of financial services sold by insurance companies and a host of new business configurations that have little regulation currently.

![Kanye West's [aka Ye] Refusal to Treat His Mental Illness Is No Excuse For His Anti-Semitism](https://images.squarespace-cdn.com/content/v1/55f45174e4b0fb5d95b07f39/1666238183530-4WVG9SNG88HTSKQ0WWDV/Is+Kanye-West-Running-Out-of-Platforms.png)