Kylie Jenner Sells 51% of Kylie Cosmetics to Coty, Making Her the Richest Kardashian

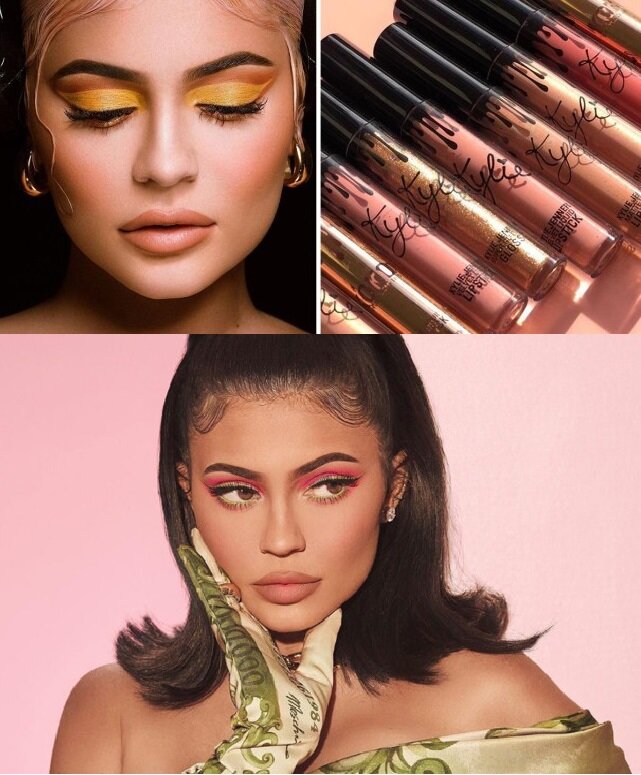

/Kylie Jenner, who recently unseated Mark Zuckerberg as the world’s youngest billionaire, is selling 51% of her stake in Kylie Cosmetics to Coty Inc. for $600 million.

"This partnership will allow me and my team to stay focused on the creation and development of each product while building the brand into an international beauty powerhouse," Jenner said.

The young mogul’s team will continue to manage her creative and communication efforts, a critical component of the deal because Jenner is one of the most-followed people on social media. Jenner delivers an audience of 150 million followers on Instagram and 30 million on Twitter.

“On social media, Kylie has over 270 million followers,” Coty Chief Financial Officer Pierre Andre Terrise said in a conference call. . “To put this in perspective, with a single post, she’s able to reach more than double the number of people who watch the Super Bowl every year.”

With Coty suffering turbulent times in an industry reeling under the success of brands like Jenner’s, the deal benefits from Jenner being a stable, prime mover of beauty products. Coty launched a $3 billion write down in value of brands it acquired in 2015 from Procter & Gamble, that included Clairol and CoverGirl. The deal also establishes Coty with another player in the younger women, direct-to-consumer sales channel. For 22-year-old Jenner, the all cash deal is a brilliant business move.

Coty CEO Pierre Laubies said in the release that the deal is "an exciting next step in our transformation and will leverage our core strengths around fragrances, cosmetics and skincare, allowing Kylie's brands to reach their full potential."

We note that some Wall Street analysts expressed skepticism over the deal, while admitting that reliable brands like Estee Lauder, Loreal and Sephora are suffering, as the industry enters choppy waters. “Brands tied to a celebrity have a unique risk in that their popularity can ebb and flow with the popularity of the celebrity,” said Rebecca Scheuneman, an analyst with Morningstar. “That’s one risk we don’t care for with the deal.”