New Study Confirms Communities of Color Are Hardest Hit By Growing Wealth Inequality

/Wynwood, Miami. Photo by Meriç Dağlı on Unsplash

By Chuck Collins, a director of the Program on Inequality at the Institute for Policy Studies. Originally published on Yes! Magazine.

The story of the growing inequality in the United States has many dimensions.

There is the overarching story of the last four decades of polarizing income, wealth, and opportunity. But the many ways these inequalities manifest depend on people’s gender, race, age, immigration status, and other experience.

One piece of the story is to understand how 40 years of public policies have worsened the racial wealth divide and enriched the top 1 percent.

Wealth is where the past shows up in the present, both in terms of historical advantages and barriers. Measures of wealth—what you own minus what you owe—reflect the multigenerational story of White supremacy in asset-building.

For example, the median White family now has 41 times more wealth than the median Black family and 22 times more wealth than the median Latino family. These are among our findings in “Dreams Deferred,” a new study on the racial wealth divide that I co-authored for the Institute for Policy Studies.

Overall, inequality has grown as wages for almost half of all U.S. workers have been flatlined since the late 1970s. Meanwhile, expenses for housing, health care, and other basic needs have risen. This has touched people of all races, fueling some of the discontent of both regressive and progressive populism.

But while wealth at the middle falters, it’s soaring at the top. The Forbes 400 group of billionaires now have as much wealth combined as the entire Black population and a quarter of the Latino population combined. And the three richest billionaires—Jeff Bezos, Warren Buffett, and Bill Gates—have as much wealth as the entire bottom half of U.S. households.

Since the early 1980s, median wealth among Black and Latino families has been stalled at less than $10,000. The median Black family today owns $3,600—just 2 percent of the $147,000 of wealth the median White family owns. The median Latino family has assets worth $6,600—just 4 percent of the median White family.

Since 1983, median wealth for all U.S. households declined by 3 percent, adjusting for inflation. Over this same period, the median Black family saw their wealth drop by more than half.

If the trajectory of the past three decades continues, by 2050 the median White family will have $174,000 of wealth, while Latino median wealth will be just $8,600—and Black median wealth will head downward to $600. In fact, the median Black family is on track to reach zero wealth by 2082.

While the middle class stagnates and the very richest leave everyone behind, there’s also growing precariousness at the bottom end of the spectrum. A growing number of households are “underwater” when it comes to wealth. The proportion of all U.S. households of any race with zero or “negative” wealth (meaning their debts exceed the value of their assets) has grown from one in six in 1983 to one in five households today.

Families of color are much likelier to be in this precarious financial situation: 37 percent of Black families and 33 percent of Latino families have zero or negative wealth, compared with just 15.5 percent of White families.

These racial wealth divisions are damaging to the economy as a whole. Low levels of Black and Latino wealth, combined with their growing proportion of the population, are a significant contributor to the overall decline in American median household wealth. By 2060, the combined Black and Latino percentage of the population is expected to rise from 30 percent to 42.5 percent.

Public policies aimed at reducing both overall inequality and the racial wealth divide in particular will be critical to creating a more equitable economic system.

Such policies could include the expansion of first-time homeownership for those who were denied access to home mortgage financing, both in the decades after World War II and up to the present day. This could include low-interest loans and down payment assistance.

Additional initiatives could remove barriers to higher education. Student debt now exceeds $1.5 trillion and discourages younger people from being able to save, build wealth and purchase homes.

U.S. Sen. Cory Booker has proposed the creation of a “baby bond” program that would seed an asset account for every newborn.

According to one study, had such a program been in place in 1979, the wealth gap between Latinos and Whites would have been entirely closed by now, and the wealth gap between Blacks and Whites would have shrunk 82 percent in young adult households.

Fishtown, Philadelphia Photo by Ashim D’Silva on Unsplash

Such proposals could be universally applied to those with no or low wealth, or be part of a more targeted reparations program linked to the legacy of slavery, Jim Crow and White supremacy. Substantial funds could be raised by a progressive tax on wealth, similar to one proposed recently by U.S. Sen. Elizabeth Warren.

By taking these measures, we would close the racial wealth gap. But we also must address the overall challenges of inequality with policies to raise the minimum wage and expand health care, while taxing the 1 percent to fund education and infrastructure that create an economy that works for everyone, not just the superrich.

Chuck Collins is also the author of Born on Third Base: A One Percenter Makes the Case for Tackling Inequality, Bringing Wealth Home, and Committing to the Common Good.

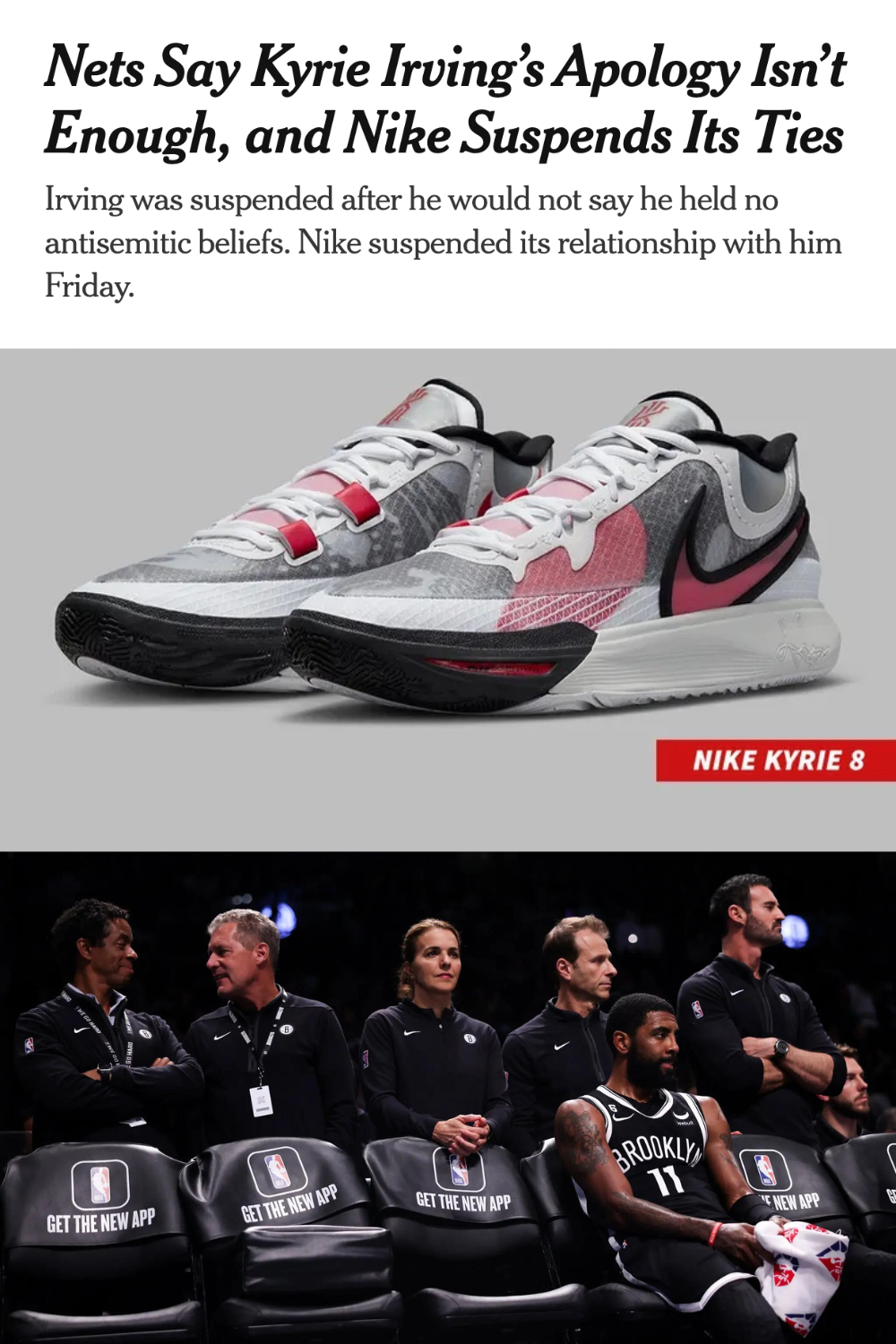

![Kanye West's [aka Ye] Refusal to Treat His Mental Illness Is No Excuse For His Anti-Semitism](https://images.squarespace-cdn.com/content/v1/55f45174e4b0fb5d95b07f39/1666238183530-4WVG9SNG88HTSKQ0WWDV/Is+Kanye-West-Running-Out-of-Platforms.png)